New figures released by the Finance & Leasing Association (FLA) show that consumer car finance new business volumes fell in March 2024 by 7% compared with the same month in 2023. The corresponding value of new business was 5% lower over the same period. In Q1 2024 as a whole, new business by value and volume fell by 3% and 4% respectively, compared with Q1 2023.

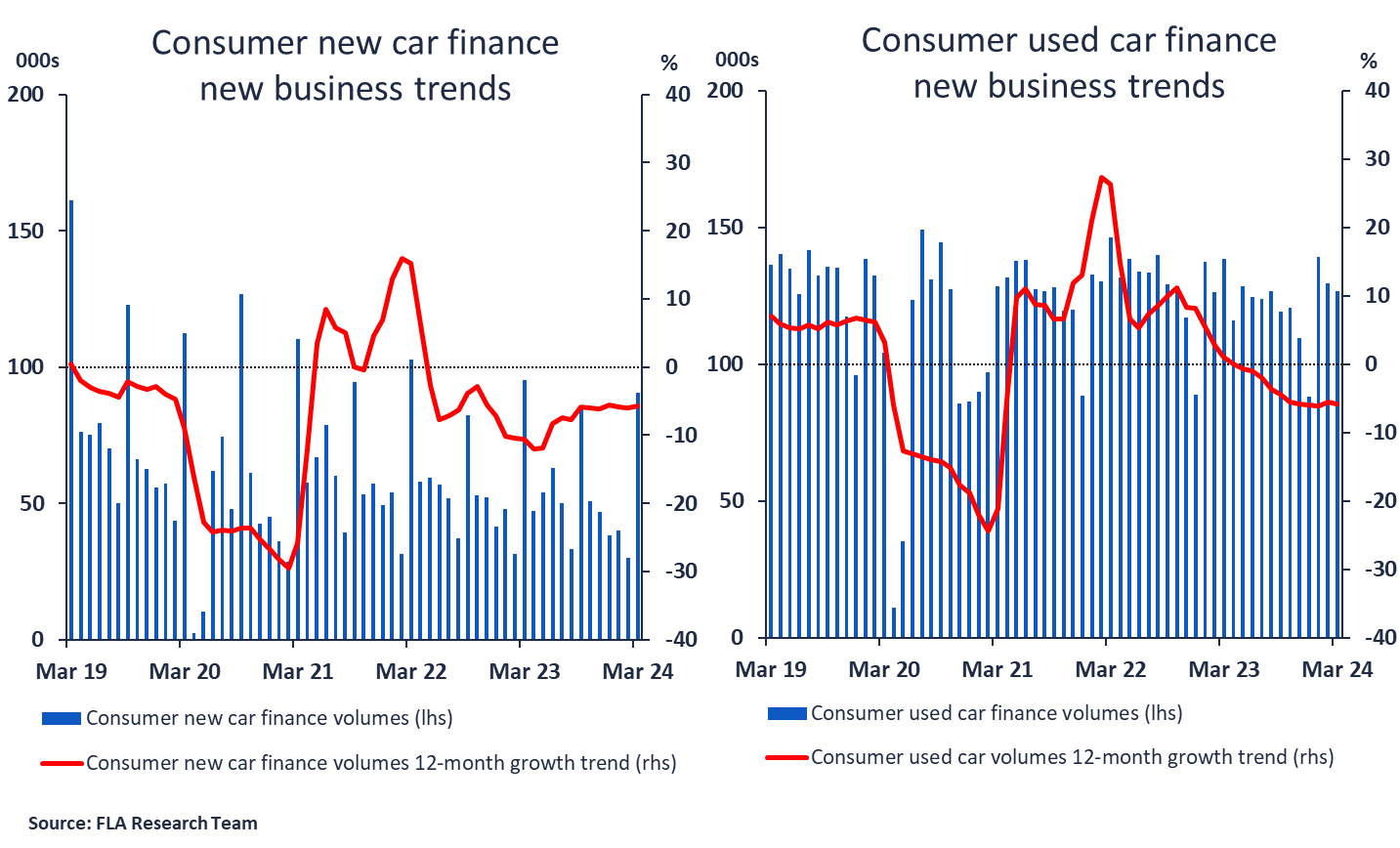

The consumer new car finance market reported new business by value in March 2% higher than in the same month in 2023, while new business volumes fell by 5%. In Q1 2024, new business volumes in this market were 8% lower than in Q1 2023.

The consumer used car finance market reported a fall in the value of new business in March of 12% compared with the same month in 2023, while new business volumes decreased by 8%. In Q1 2024, new business volumes in this market were 2% lower than in Q1 2023.

Commenting on the figures, Geraldine Kilkelly, Director of Research and Chief Economist at the FLA, said:

“The performance of the consumer new car finance market in the first quarter of 2024 was in line with trends in private new car registrations which fell by 9%. The percentage of these sales financed by FLA members has increased in recent months to 78.9% in the twelve months to March 2024.

“The rebound in the economy demonstrated by the latest official data was reflected in the FLA’s Q2 2024 Industry Outlook Survey which showed 80% of motor finance respondents expected some improvement in economic conditions over the next 12 months. Over the same period, more than three-quarters of respondents anticipated some increase in the value of new business.

“As always, customers who are worried about meeting payments should speak to their lender as soon as possible to find a solution.”

For more information e-mail research@fla.org.uk

Finance & Leasing Association

Finance & Leasing Association