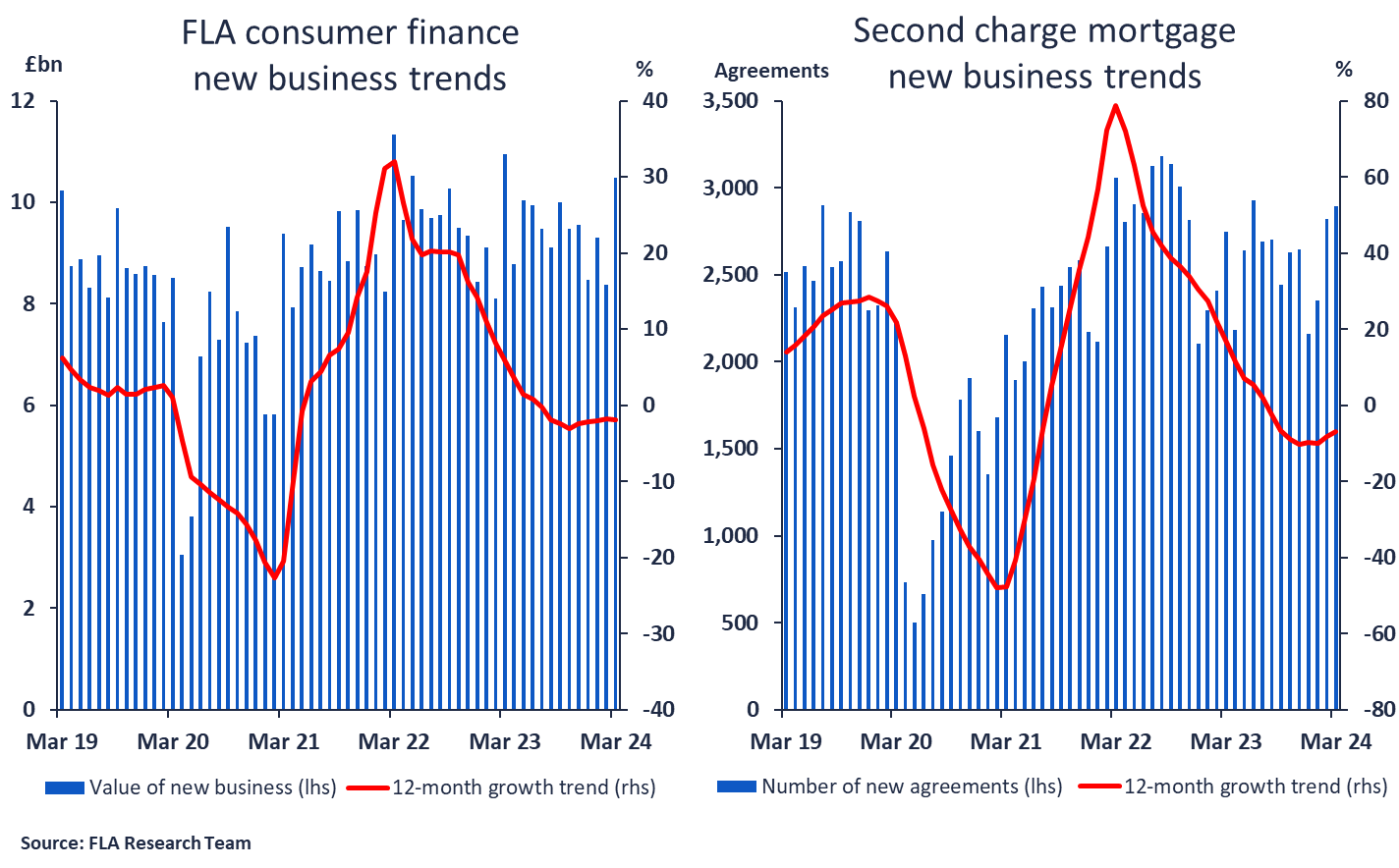

New figures released by the Finance & Leasing Association (FLA) show that consumer finance new business fell in March 2024 by 4% compared with the same month in 2023. In Q1 2024 as a whole, new business in this market was at a similar level to Q1 2023.

The credit card and personal loans sectors together reported new business 3% lower in March compared with the same month in 2023, while the retail store and online credit sector reported new business 14% lower over the same period.

Commenting on the figures, Geraldine Kilkelly, Director of Research and Chief Economist at the FLA, said:

“Consumer finance new business held steady in Q1 2024, which together with growth in household real disposable incomes supported the recovery in consumer spending during the first quarter of the year.

“The rebound in the economy demonstrated by the latest official data was reflected in the FLA’s Q2 2024 Industry Outlook Survey which showed 82% of consumer finance respondents expected some improvement in economic conditions over the next 12 months. Over the same period, 88% of respondents anticipated some increase in the value of new business.

“As always, customers who are worried about meeting payments should speak to their lender as soon as possible to find a solution.”

For more information e-mail research@fla.org.uk

Finance & Leasing Association

Finance & Leasing Association